Customer of Pools: Maximizing crypto rewards

The world of cryptocurrencies has exploded in recent years, with total market capitalization over $ 2 trillion. One of the most exciting aspects of this rapidly growing space is storage, which rewards investors for keeping and storing the cryptocurrency on the blockchain network. In this article, we are immersed in the concept of storing pools, how they work and how to maximize crypto rewards.

What is your seat?

Storage includes the closure of cryptocurrencies in a pool, where they are merged with other investors to agree on Blockchain’s shared consensus. The security of the network relies on the power of all participants’ collective hash, providing an attractive opportunity for those who want to reward while minimizing their risk.

How does the headquarters work?

Here is a step -by -step breakdown of storage:

1.

- Create a pool : Create the pelvis and put on cryptocurrencies.

3.

- Safety measures : In order to prevent exploitation or manipulation, stocks use security measures such as multisignatures, smart contracts and management mechanisms.

- Reward distribution : The pool allocates the rewards obtained during the period fixed by all participants.

Types of buyer pools

There are two main types of storage pools:

- Solo Staking : In this approach, cryptocurrencies are made separately within a single pool.

- Storage of stakeholders : This type includes the merger of coins with others to increase collective hash performance and the degree of reward.

Advantages of storing pools

The use of stocks offers many benefits:

* Increased Rewards : By participating in the pool, you can earn more rewards than if you were to do the coins separately.

* Diversification : You can diversify your portfolio by investing in multiple pools, distributing risk and increasing potential returns.

* Community Commitment : Warehouse exercises often offer community management mechanisms, allowing you to participate in decision -making processes.

* Safety : Pool operators usually take robust security measures to protect the integrity of the network.

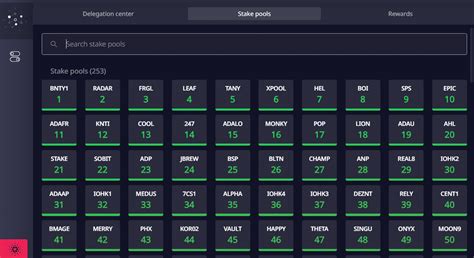

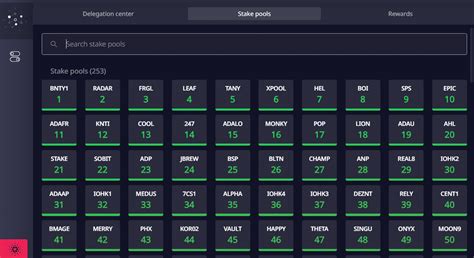

Popular legumes are

Some popular stocks are as follows:

- Slushpool : One of the largest and best -known storage pools with competitive rewards and user -friendly surface.

- Binance Staking : Binance’s Staking Pool offers a wide range of cryptocurrencies, with competitive reward rates and low prizes.

- StakePool : Community -driven dough kit that allows users to participate in government decisions and reward.

To start storage of pools

Follow these steps to start the pools:

- Research different options and choose a pool that meets your needs.

- Create an account on the platform of the sliding kit and place the cryptocurrencies.

- Understand the conditions of the pool, including the degree of reward and control mechanisms.

Conclusion

Inventories offer a comfortable method of maximizing crypto rewards while minimizing the risk. If you understand how storage and the choice of a reputable pool work, you can take advantage of the exciting places offered. Don’t forget to do the research, set clear goals, and start with solid foundations before immersing in the pools.

More sources

- [Inventory Comparison: Guide] (